Update : 2023-2-6

From February 16 (Thursday) to March 15 (Wednesday) filing income tax return will be accepted at Kawagichi Site.

Filing of municipal /prefectural tax (inhabitant tax) and income tax return for the people who have employment income and/or miscellaneous income (public pension etc.) will be accepted at Chuo Kominkan (Chuo Public Hall) in Soka City from February 16 to March 2.

Please note that a place varies depending upon contents of tax returns and reception period.

As many taxpayers are expecting at the beginning of the reception period and reception may be closed earlier.

(Tax return by mail is convenient)

* Please check your temperature and wear a mask when you visit the sites.

* Persons who have fever 37.5℃ and over or cold symptoms are not allowed to enter the sites.

e-Tax is convenient!

Final Tax return from your smartphone or PC using "Tax return makin corner" at your home!

You can easily declare tac return by e-Tax at your home with smartphone and "My Number Card"; not waiting for long time at the site. We hope you can try this time.

"Kakutei Shinkokusho (Tax return making) Sakusei Corner" in Englishi, Chinese, Vietnamese, Portuguese and Napali is available at:

https://www.nta.go.jp/taxes/shiraberu/shinkoku/tebiki/2022/foreigner/index.htm

Things prepared in advance

(1)"My Number Card (plastic)"

(2)Password (4-digit) for "Electronic certificae of user proof" which was set when you got (1) (Passwords for "Electronic certificate of the bearer's signature" and "input auxiliary" are required in the first time)

(3)Install "Mynaportal" app to a smart phone which corresponding to the "My Number Card reader"

Filing income tax return at SKIP City in Kawaguchi City:

For income tax, consumption tax, gift tax: February 16 (Thursday) to March 15 (Wednesday) except Saturdays, Sundays and holiday, from 9時0分 a.m. to 4時0分 p.m.

* Open on Feb. 19 (Sun.) and 26 (Sun.)

(300 parking lots are available)

* Line-ticket, distributed on the day, is required to enter.

* You can get a line-ticket in advance by On-line through LINE.

How to go to the SKIP City (address: Kami Aoki 3-12-18, Kawaguchi City)

How to go to the SKIP City (address: Kami Aoki 3-12-18, Kawaguchi City)

There are two ways to go. Both routes need to use two buses.

- Take a bus from No. 1 platform of Soka Station (west exit) to the terminal "Kawaguchi-eki Higashi-guchi (east exit)" From there take any bus leaving from No. 7 ~ No. 9 bus platforms and get off at "Kawaguchi Shiritsu Koukou" bus stop. 5-minute walk from the bus stop.

- Take a bus from No. 2 platform of Soka Station (west exit) to the terminal "Hatogaya-eki Higashi-guchi (east exit)" From the west exit of Saitama Kosoku Tetsudo (Saitama Railway) "Hatogaya-eki Higashi-guchi" take a bus for "Kawaguchi-eki Higashi-guchi (east exit)" and get off at "Kawaguchi Shiritsu Koukou" bus stop. 5-minute walk from the bus stop.

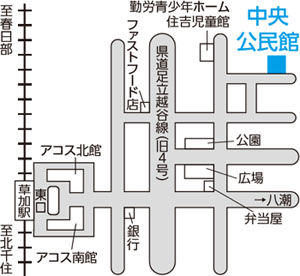

Filing income tax return at Chuo Komin-kan (Public Hall) in Soka City

For those who have employment income and/or miscellaneous income (public pension, etc.) and claim simple tax returns such as support, life insurance, medical expense deduction etc.:

February 16 (Thursday) to March 2 (Thursday) except Saturdays, Sundays and holidays, 9時0分 a.m. to 2時30分 pm. Limited to 200 people per day.

* Accepting time may be changed according to that day's congesting situation.

* The first half of the term is crowded every year.

* No parking lots. Public transportation or using bicycles is recommended.

Eligible person

At this site only those who have employment income/income from public pension can claim simple reductions (support, life insurance, additional procedure of medical expense).

* Chuo Kominkan (Public Hall) cannot accept the inquireis about filing tax.

* Please cooperate to visit by public transportation or bicycles to reduce congestion

Caution: Those who claim tax credit relating housing loans, or those who have business income, real estate income or income from the transfer of land, building, stock etc. should

Submit at the SKIP City !

Inquiry

Kawaguchi Zeimu-sho (Tax Office)

Tel.(048) 252-5141

Filing income tax return by mail: 〒332-8666 Aoki 2-2-17, Kawaguchi-shi

Filing Municipal/prefectural tax report at Chuo Komin-kan (Chuo Public Hall) in Soka City:

February 16 (Thursday) to March 15 (Wednesday) except Saturdays, Sundays and holidays, from 9時0分 a.m. to 3時30分 p.m.

* Municipalprefectural tax report at the Shimin-Zei-ka (Taxation Section) in City Hall will NOT available from February 16 to March 15.

*Income tax return at Kawaguchi Tax Office will not available from February 16 (Wednesday) to March 15 (Tuesday).

All the citizens except following people need to file

(1)Those who submit income tax (national tax) return

(2)The person whose income is only from employment and his/her salary payment report from office has submitted to Soka City (comfirm your employers)

(3)The person whose income is only from public pension of 4,000,000 yen or less, and the payment report has submitted to Soka City.

* The person who will apply for additional deduction except the deduction on "Gensen Choshu-hyo (withholding tax form)" or received pension based on foreign country's law or private pension needs to file.

(Note)Those who are non-taxable for income or municipal/prefectural tax are not eligible.

But even if you are non-taxable you have to report your 0 income to receive public service (national health insurance, child allowance/daycare etc.)

Convenient filing by Postal-mail

You can submit the return tax form by postal mail which make you free from a burden of waiting for a long time at the site for tax retrun.

If you don't have a tax form, ask the shiminzei-ka (Taxation Section) in the City Hall/

(2)A copy of personal identification document

(3)A copy of the document to certify your `My Number (Individual Number)'

(4)Document to certify your income like a `Gensen Choshu-hyo (withholding tax form) from your company

(5)Certificate paper for reduction etc.

Necessary things

For income tax return, municipal/prefectural tax report

○Personal identification documents

○"My Number Card (plastic)"

or My Number Notification Card (paper)

○Tax form if you received from Soka City (form is available at the site)

○Gensen Choshu-hyo of 2022 if you had salary income or public pension

○Documents certifying your other income for tax report

○Individual Number ("My Number") of your family members (whose income was 480,000 yen or less) of same household when you apply for tax deduction for dependants.

○Shogai-sha Techo (Certificate for the people with disabilities)

* Approval Certificate of the 1st to 5th level of Needed Long-Term Care from Kaigo Hoken-ka

○Receipts or certificates for each deduction

○Receipts or detailed statement of medical expenses paid in 2022 for medical expense deduction.

For income tax return

○Bankbook in the name of the person (* in case of receiving refund)

○Something to show your "ID Number of User"

"Notice of ID Number of User", " "Notice for income tax return (post card)" from Tax Office, " Confirmation slip of declaration (issued after filing tax return with 'Tax return making corner' on the web)

○If you have business income or real estate income, completed "Aoiro Shinkoku Kessan-sho (Blue return account statement)" or "Shushi Uchiwakesho (Payment itemized statement)" .

For municipal/prefectural tax report

○If a representative is not a family member of the same household or a legally appointed representative, a proxy letter is necessary.

○Account book, Shiharai-chosho (payment record), receipts etc. if you have business income or real estate income

Inquiry

Shimin-Zei-ka (Taxation Section)

Tel.(048) 922-1042

* Filing municipal /prefectural tax at City Hall will not available from February 16 (Wednesday) to March 15 (Tuesday).

* Chuo Komin-kan (Chuo Public Hall) cannot accept inquiries about filing tax.

To Foreign Residents:

Support at Chuo Komin-kan for tax return is available for the foreign residents who have a difficulty in hearing, reading and writing in Japanese. Please consult the date and time in advance.

* English or Chinese

* It is not always available of date and time due to interpreters' schedule.

Apply and enquiries: Intercultural Information Corner

Tel.(048) 922-2970 (Mon., Wed. and Fri.)

* If you need further information about filing taxes, a leaflet "Useful Information (Tax Return) in English is available at "Intercultural Information Corner", Taxation Section in City Hall, service centers.